Your financial organization will find it hard-pressing to achieve success in today’s business world if it is not flexible enough to a continuously growing standard of customer service. However, CRM finance software developed by bpm’online is meant to help your bank get a total understanding of your potential and real clients’ needs and expectations with the aim of providing them with a relevant financial product or service at the proper time.

A progressive CRM finance builds up fruitful customer relationships starting with the very first stage of clients’ acquisition and ending with turning potential buyers into loyal customers. Such software presents an automation platform, which contributes to customer’s lifecycle by suggesting your business development managers the most effective ways of communicating with your clients. Also, CRM finance finds the advanced strategies of increasing up and cross-selling. Performance capabilities of cloud CRM software seem to be endless, however let us highlight the most useful of them.

CRM Finance is Customer-oriented

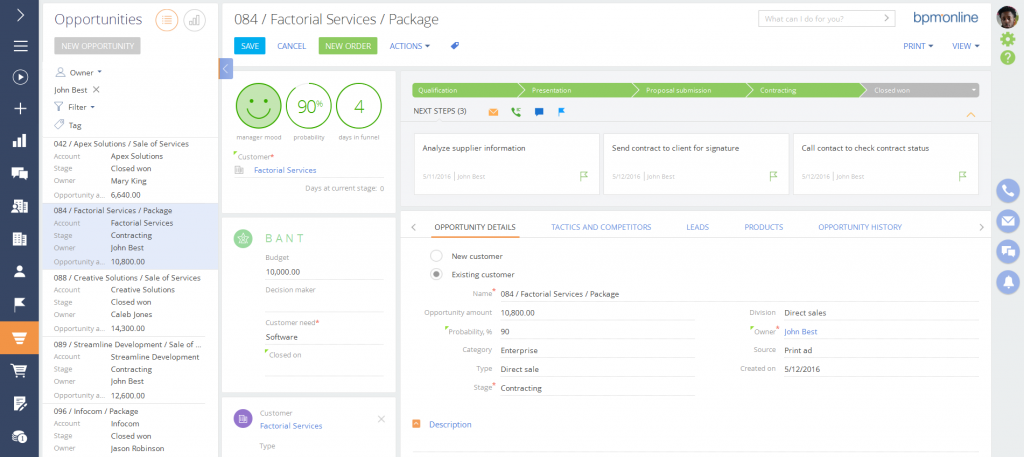

CRM finance smartly implements automated sales processes, helping your financial team choose the optimal tactics tailored for every client at each step of a sales process:

- it performs needs analysis of your clients;

- CRM finance estimates paying capacity of your bank partners;

- this advanced platform forecasts potential earnings of every closed deal;

- the automation solution completes the profile of every client, including social networks data, history of communication, transactions and their financial statements;

- with such an intelligent system your bank will be able to rate a perspective and actual valence of each customer in order to use the partnership opportunities to the fullest, in other words to get the maximum profit from every client, keeping them utterly satisfied with your bank’s financial services and products.

Financial CRM Increases Revenue

By giving your financial establishment a detailed perspective of your clients, an advanced CRM finance solution like https://www.bpmonline.com trains your managers to work with the customers easily, to attract them with suitable bank products and retain the clients with personalized offerings. CRM tracks users’ behavior and helps the managers focus on more profitable clients. In result, your representatives will be much more productive. The better your managers do their job – the more profitable and prosperous your bank becomes. Top-notch CRM system is your guarantee of steady income, new clients’ acquisition and retention combined with noticeable optimization of the operational costs by automation and standardization of all business processes.

CRM unifies All Available Information

The great advantage of CRM, developed specifically for financial institutions, is in its ability to unitize all the business processes, providing companies with a comprehensive approach to the history of all transactions. Now employees, departments and bank branches can immediately exchange clients’ information without any gaps as CRM platform automatically gathers, analyzes and stores all received information in a generalized database. Up-to-date administration tools make it possible to modify CRM in accordance with your bank’s objectives and tasks.

CRM System Increases the Levels of Customer Satisfaction

Loyal customer relationships are crucially important for any financial organization, but it is very difficult to meet all the clients’ demands and specific requirements due to enormous competition, which results in shortening of bank products and services life cycles. That is why, companies need to be inventive and provide clients with individual proposals through the communication channels, which a concrete client prefers.

Through deep analysis of the activities of every customer, whether it is a prospect or an existing one, CRM finance suggests the most appropriate channels of distribution – via the Internet, personalized emailing, messaging or home banking.

Bpm’online developed a cutting-edge CRM finance solution that manages and controls execution of promotions according to bank products and client groups, reports on customers’ feedback on different marketing offers and evaluates efficiency of promotion campaigns. Having introduced CRM software, you prevent your staff from committing even slightest mistakes while performing a transaction or signing a contract, which makes your bank more prioritized and trusted and turns your clients into loyal ones who make repeated financial purchase on a regular basis.

To sum up, financial CRM is aimed to give your bank a better understanding of your clients’ demands. In turn, your prospects will turn into your loyal customers, as your company suggests personalized offers via communication channels your patrons prefer. Also, your firm will be able to decrease the costs connected with customers’ acquisition and retention. Not to mention that, your team will have an instant access to the customer database to update a client’s profile or track his buying behavior.