Under the traditional way of trading, you place your order to the broker online or by telephone, and the broker then gets a quote for your order from a market maker company, which is prepared to buy and sell stock. A market maker quotes both an offer and bid price and hopes to profit from the difference between those two figures. Brokers usually contact multiple market makers and give you the best quote, which is good for a certain period of time – for example, ten seconds. This is known as a “quote-driven market,” but thanks to the introduction of DMA and electronic trading, there is now also an “order-driven market.”

Enter DMA Trading

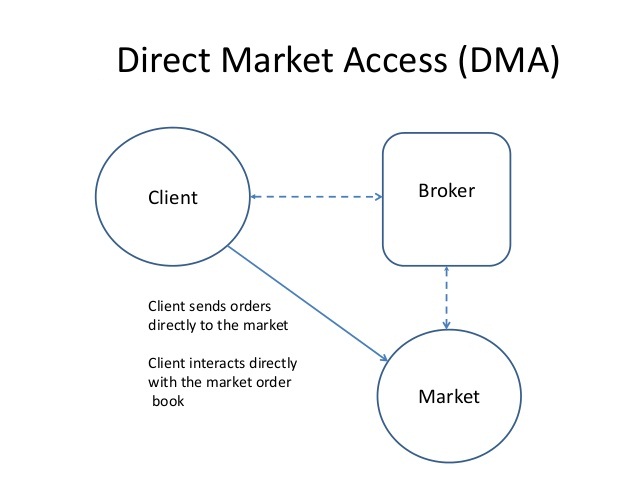

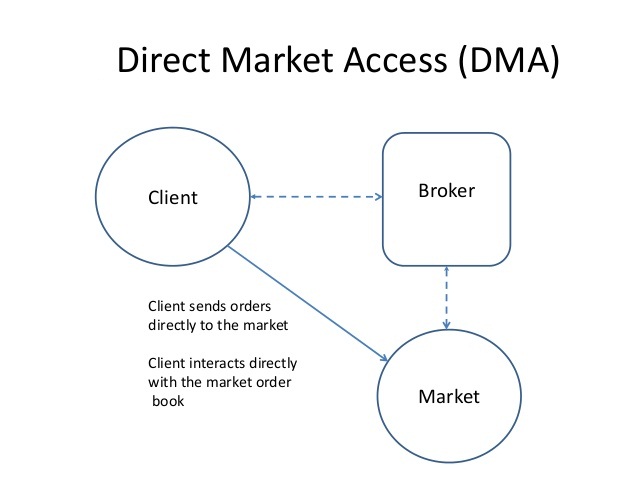

DMA trading is a departure from the traditional model in the sense that you are placing an order directly with the stock exchange. In an order-driven market, the exchanges have an order book that participants use to submit the prices they will pay and the amount they’re willing to sell and buy. Their orders stay on the book until they are cancelled or accepted.

If a trader places an order to sell and another one to buy at the same price on the book, the book will match those two figures and the trade will be executed. Additionally, if a trader places an order to sell or buy at market rather than a specified price, he or she will be matched with the order book’s best available price.

Even when an underlying market is of the order-driven variety, brokers may not put your order into the book. If you want your transaction executed immediately, the broker may give you a market maker quote. If you placed a limit order to be processed if a share passes your set price, it goes into the broker’s system and is executed via a market maker if that price is reached.

The benefits of DMA

When your broker offers DMA, your order will go right into the exchange’s book. This creates a subtle shift in your relationship with that market as you go from accepting a quote from a market maker to making the offer directly.

Here are some other DMA benefits to consider:

-

Without the use of an in-between, your orders are executed faster.

-

It lessens the chance of human error, such as a person at the brokerage or market maker company making a mistake with your order.

-

You should get a slight improvement on price because there’s no cut for the market maker involved.

-

Without a broker representative involved, you’ll receive more anonymity.

-

Some trading strategies tap into the use of DMA, usually by giving you more control over your order’s execution.

Keep in mind that there is true DMA, when your order goes right to the exchange with no human intervention required, and one-touch DMA, when someone has to press a button to authorize the passage of your order to the exchange. Some countries will not allow true DMA and only permit one-touch DMA for foreign investors, so make sure you know what type of DMA you’re getting when you place an order.